texas travel nurse taxes

Make sure to deduct any travel reimbursements from the travel nursing agency. The fact that the income was not earned in the home state is irrelevant.

Ask A Nurse What Tax Benefits Can I Claim As A Registered Nurse Nursejournal

While working as a travel nurse adds an additional layer of tax challenges it can also be a great way to gain a tax advantage.

. I could spend a long time on this but here is the 3-sentence definition. I paid Ohio weekly taxes while I was there for 13 weeks. This means travel nurses can no longer deduct travel-related expenses such as food.

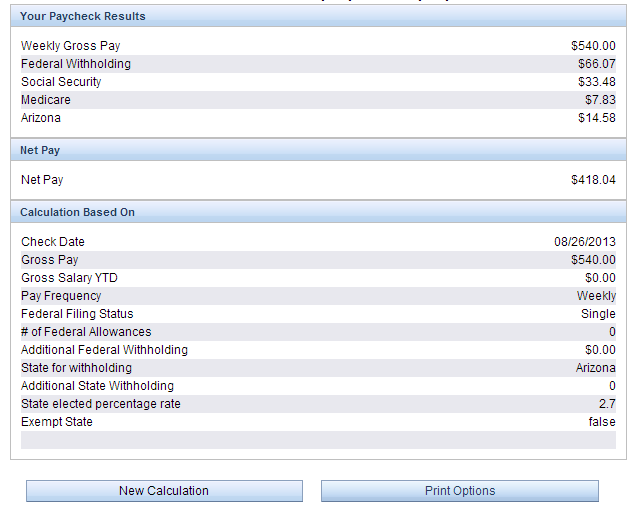

Thats why we make staying compliant a top priority for our company and all of TNAAs travelers. You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. If you worked 50 out 52 weeks in 2021 and your base pay hourly rate was 67 and your weekly travel stipend was 1085 you would have a total.

But there is hearsay. While higher earning potential in addition to tax advantages are a no. If you were working as a Staff Nurse you would typically be unable to write off housing travel or food expenses on your taxes.

Not just at tax time. For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable.

Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year. Tax-write offs are a unique ability of Travel Nurses and other Allied Pros but this benefit depends on your ability to prove that you have a tax home. When travel nursing companies advertise pay rates they will often tell you a blended rate.

TNAA is proud to be a member of the National Association of Travel Healthcare Organizations NATHO. This is the most common Tax Questions of Travel Nurses we receive all year. First your home state will tax all income earned everywhere regardless of source.

Texas does not have state income taxes. At Travel Nurse Across America we know that tax compliance and healthcare traveler documentation can be complicated. For a travel nurses stipends reimbursing travel and living expenses to qualify as tax-free under IRS rules the nurse must establish what is known as a tax home which is generally the city or area in which a taxpayers main place of work or business is located and where he or she earns the most income.

Its not enough to simply abandon a residence but establish a new one. Two basic principles are at work here. Taxes and travel nursing can be very complicated so its best to consult an accountant.

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS FREE YEARLY TAX ORGANIZER WORKSHEET FEDERAL AND STATE TAX PREPARATION YEAR ROUND AVAILABILITY REPRESENTATION. Companies can reimburse you for certain expenses while working away from your tax home. Im a travel nurse whose Home state is Texas.

To make matters worse travel nurse taxes are probably the most challenging and disliked part about travel nursing. Travel nurse income has a tax advantage. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax reimbursement payments in a typical year of work as a travel nurse.

Here is an example of a typical pay package. How do I do the state income tax for Ohio. Well unfortunately travel nurses can see the country and escape the monotony of full-time employment but they cannot escape paying taxes.

Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming do not have income tax. Since travel nurses are working away from their tax home certain companies must legally provide stipends andor reimbursements for their work more on this below. This is how a lot of travel nurses handle taxes.

For a 1500 mile trip you can deduct 80250 Travel Nurse Tax Deduction 3. Or are paid a fully taxable hourly wage taxed on the total rate of pay. Travel nurses are granted tax-free stipends and travel nurses save up to 10k annually compared to permanent nurses.

Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other. There are two ways you can be paid as a travel nurse. Travel expenses from your tax home to your work.

These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. Qualifying for non-taxable income. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable.

This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given contract. At the same time the work state will. I worked their during COVID for 13weeks to help them.

For nurses domiciled in a compact state the filing of a resident tax return is universally expected for renewal or validity. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage. A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Nursing boards and state tax agencies readily exchange information and some states treat tax delinquency as a basis for non-renewal of a license. The expense of maintaining your tax home.

1 A tax home is your main area not state of work. Also nurses are free to go anywhere in their breaks. Having no tax homes means they stay in hotels and hence more cost.

Some states are exempting travel nu. Having a tax home will solve this problem. Typically there are stipends or reimbursements for travel nurses.

Unfortunately you can only receive the tax-free stipend option if you can claim a permanent tax-home. Travel Nurse non-taxable income. 20 per hour taxable base rate that is reported to the IRS.

In 2017 the IRS allows for write-offs at the standard mileage rate of 535 cents per mile. Travel nurse taxes are due on April 15th just like other individual income tax returns. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses.

Here are some categories of travel nurse tax deductions to be aware of.

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Infographic How To Get Your First Travel Job Nursing Jobs Travel Nurse Jobs Travel Nursing

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How To Become A Travel Nurse Salary Requirements

How To Make The Most Money As A Travel Nurse

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How Much Do Travel Nurses Make Factors That Stack On The Cash

Sample Travel Nursing Assignment Nursing Jobs Travel Nursing Nurse Job Interview

Everything You Need To Understand About Traveling Nursing Taxes

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

What Is Travel Nursing How To Become A Travel Nurse Salary Registerednursing Org

Lpn Travel Nurse Salary Comparably

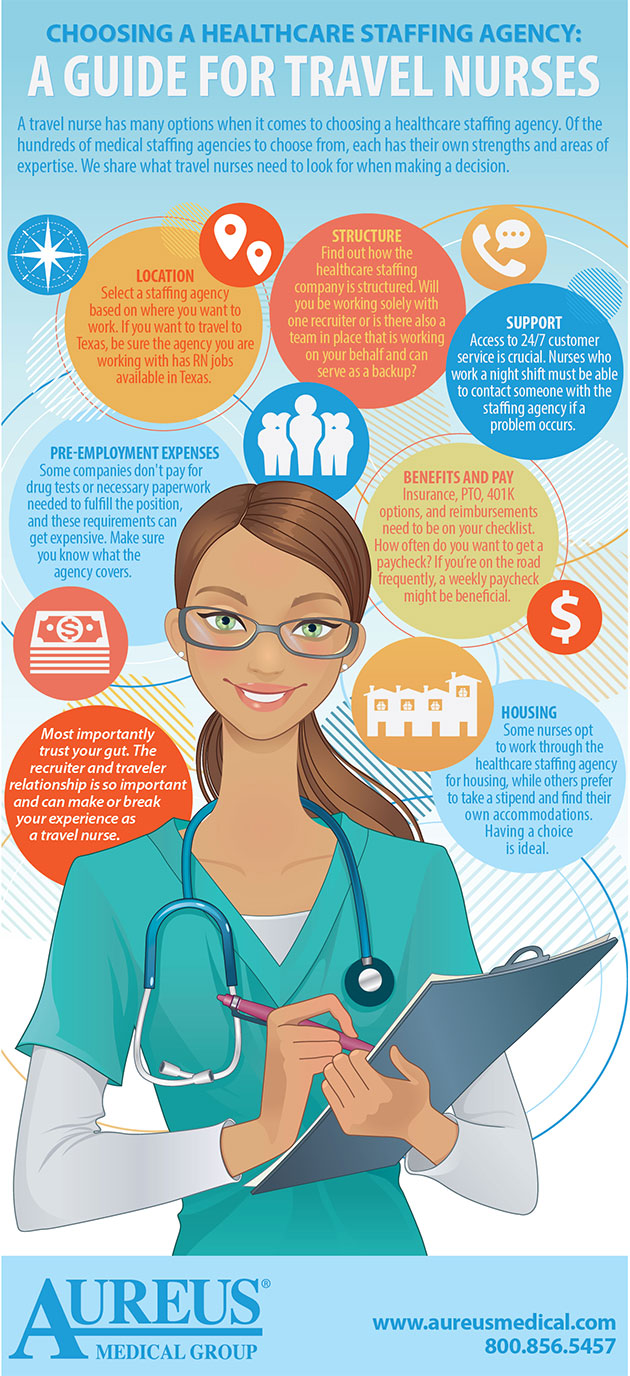

Infographic Travel Nursing Careers Choosing A Healthcare Staffing Agency

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Can Travel Nurses Work Part Time Trusted Nurse Staffing

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

States With Highest And Lowest Sales Tax Rates

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing